BTC Price Prediction: Navigating Critical Support Levels Amid Market Uncertainty

#BTC

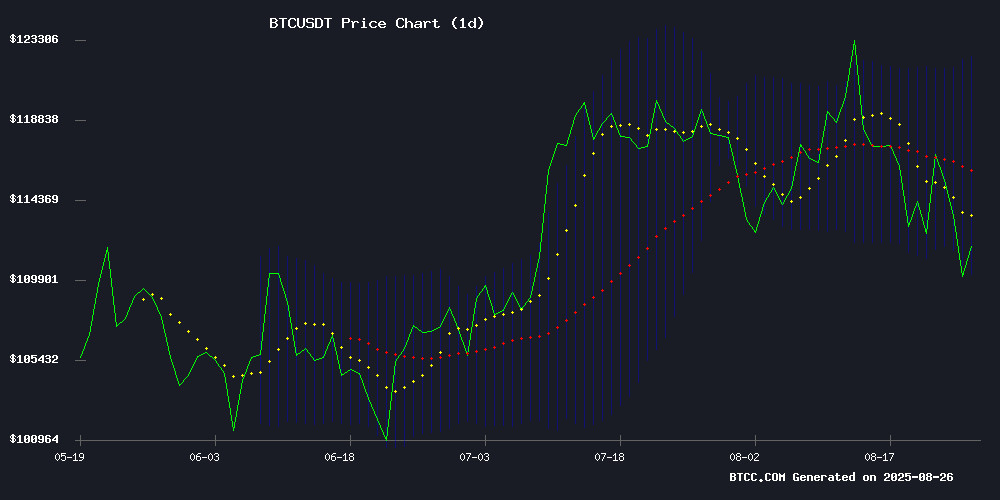

- Technical Support Levels: BTC is testing critical support at $110,097 (lower Bollinger Band) with the 20-day MA at $116,276 acting as immediate resistance

- Market Sentiment Impact: Negative news flow including ETF outflows and large liquidations is creating near-term headwinds despite strong institutional accumulation

- Price Projection Framework: The $110,000-$116,000 range will determine near-term direction, with breaks either side likely triggering significant momentum moves

BTC Price Prediction

Technical Analysis: BTC Faces Critical Support Test

BTC is currently trading at $111,216, below its 20-day moving average of $116,276, indicating short-term bearish pressure. The MACD shows a positive but narrowing momentum with the histogram at 1,605, suggesting weakening bullish momentum. Price is hovering NEAR the lower Bollinger Band at $110,097, which serves as immediate support. A break below this level could trigger further downside toward $105,000.

According to BTCC financial analyst William: 'The technical setup shows BTC testing crucial support levels. The $110,000 zone has become a battleground between bulls and bears. While the MACD remains positive, the price action below key moving averages suggests caution in the near term.'

Market Sentiment: Negative News Flow Weighs on BTC

Recent headlines show a confluence of negative catalysts affecting Bitcoin sentiment. The break below $110,000 for the first time since July has triggered substantial liquidations totaling $800 million. Meanwhile, Bitcoin ETFs are experiencing a six-day outflow streak, indicating retail investor panic. Notable bearish commentary from critics like Peter Schiff warning of potential drops to $75,000 adds to the negative sentiment.

BTCC financial analyst William notes: 'The news FLOW aligns with technical weakness. Institutional acquisitions by MicroStrategy and sovereign mining operations by the UAE provide underlying support, but current market sentiment remains challenged by technical breakdowns and ETF outflows.'

Factors Influencing BTC's Price

U.S. Commerce Department to Publish GDP Data on Blockchain Under Trump Administration

Howard Lutnick, former Cantor Fitzgerald CEO and current Commerce Department head under Trump, announced plans to publish U.S. GDP data on a blockchain to enhance government transparency. "We are going to put out GDP on the blockchain so people can use it for data distribution," Lutnick declared, framing the MOVE as part of Trump's pro-crypto agenda. The initiative, still in finalization, will share real-time economic data across federal agencies and with the public.

The effort is backed by David Sacks, the White House's top crypto and AI adviser, who also facilitated Trump's Bitcoin strategic reserve unveiled earlier this year. Lutnick, a longtime Bitcoin advocate who has compared it to gold, has consistently defended stablecoins like Tether despite regulatory scrutiny. The blockchain push signals a broader institutional embrace of crypto infrastructure under the administration.

Bitcoin Drops Below $110,000 for the First Time Since Early July

Bitcoin fell to its lowest level in seven weeks on Tuesday, relinquishing gains made after Fed Chair Powell hinted at potential interest rate cuts. The cryptocurrency, which reached an all-time high of $124,000 on August 14, has since retreated by approximately 12%, dipping to $108,700 earlier today—a level not seen since July 9.

Market analysts warn of a potential bull trap, where prices briefly rally before sharply reversing, catching investors off guard. Key support levels to monitor include $107,000 and $100,000, while resistance looms near $117,000 and $123,000. The recent downturn follows reports of large investors liquidating positions and increased outflows from bitcoin ETFs.

Bitcoin Slips Below Key Support, Triggering $800M Liquidations Amid ETF Resilience

Bitcoin's price action turned bearish as it breached the $110,800 support level, sliding below its 100-day EMA. The drop to $108,666 during Asian trading hours liquidated 179,700 traders, with BTC positions accounting for $267 million of the $800 million total wipeout.

Spot Bitcoin ETFs recorded $219 million in fresh inflows despite the sell-off, while institutional accumulation continued with Statergy adding 3,081 BTC to reserves. This divergence highlights the growing divide between Leveraged retail positions and institutional conviction.

The liquidation cascade predominantly affected overleveraged longs, with CoinGlass data revealing concentrated pain at the $110,000 threshold. Market structure appears to be resetting as weak hands exit and strategic buyers accumulate at lower levels.

UAE Government Mines 6,333 Bitcoin in Sovereign Wealth Strategy

The United Arab Emirates has accumulated 6,333 BTC worth approximately $700 million through state-controlled mining operations, according to blockchain intelligence firm Arkham. Unlike the US and UK governments which acquire bitcoin through asset seizures, the UAE's holdings originate from Citadel Mining—a venture with direct ties to Abu Dhabi's royal family through a complex ownership structure.

This sovereign mining operation represents a strategic pivot for the oil-rich nation, converting petrodollars into digital assets through industrial-scale production. The Royal Group controls 61% of International Holding Company, which owns 85% of Citadel Mining, creating an institutional framework for perpetual bitcoin generation.

"This is a unique case of nation-state bitcoin accumulation," noted Arkham's report. The UAE's approach establishes a renewable mechanism for digital asset acquisition, contrasting with other governments' reliance on market purchases or confiscations. Sovereign mining operations may emerge as a new frontier in national treasury management strategies.

Sequans Files $200M Plan to Build Bitcoin Treasury Targeting 100K BTC by 2030

French semiconductor firm Sequans has formally filed a $200 million equity offering with the SEC, earmarking proceeds for aggressive Bitcoin accumulation. The Paris-based company, which already holds 3,000 BTC ($331 million), aims to amass 100,000 BTC in corporate reserves by 2030 through its ATM equity program.

CEO Dr. Georges Karam positions the move as strategic exposure to digital assets, despite shareholder dilution risks. The offering complements $189 million in existing convertible debt, bringing total recent financing to $376 million. Sequans now ranks among Europe's largest corporate BTC holders behind Germany's Bitcoin Group SE.

Bitcoin Tests Critical Support Levels as Market Watches for Bull Cycle Integrity

Bitcoin's sharp reversal from recent highs has traders scrutinizing key support zones. The cryptocurrency now hovers near a crucial $100K–$107K range, where historical metrics like the Short-Term Holder Realized Price and 200-day SMA converge—a level analyst Axel Adler Jr. calls "the bull market’s last stand."

A secondary support tier at $92K–$93K marks the cost basis for mid-term holders. The market remains on edge after a single entity dumped 24,000 BTC ($2.7B), triggering liquidations that erased nearly $1B in leveraged longs. This flushout pushed BTC to seven-week lows under $109K.

Michael Saylor's MicroStrategy Acquires 3,081 BTC in Latest Strategic Move

MicroStrategy, under Michael Saylor's leadership, has bolstered its Bitcoin holdings by purchasing an additional 3,081 BTC for approximately $357 million. This acquisition elevates the company's total Bitcoin reserves to 632,457 BTC, surpassing 3% of the total Bitcoin supply—a threshold Saylor hinted at in early August.

The funding for this purchase came primarily from the sale of 875,301 MSTR shares, worth $310 million, over the past week. This aligns with Saylor's recent at-the-market (ATM) strategy, which advocates using MSTR stock to fund Bitcoin acquisitions even when the premium drops below 2.5x. Critics argue this dilutes shareholder value, while proponents view it as a strategic maneuver to accumulate more BTC.

MSTR's liquidity and market cap—now ranking as the 106th largest U.S. company at $97.6 billion—have sparked speculation about its potential inclusion in the S&P 500 Index. The stock's recent volatility, however, has seen it decline twice as much as Bitcoin in the same period.

Bitcoin Faces Resistance at $110K as Market Sentiment Sours

Bitcoin's struggle to hold the $110,000 level intensifies as on-chain metrics flash warning signs. The Taker-Buy Sell Ratio languishes at 0.96, signaling sustained derivatives sell pressure since July. Futures traders appear to be retreating from bullish positions, reflecting dwindling conviction in a near-term rebound.

Spot markets echo this caution. CryptoQuant's 90-day Cumulative Volume Delta reveals a similar exodus among现货 traders. The convergence of weak derivatives and spot demand creates a precarious technical setup, with the psychological $110K support now under threat.

UAE Mines 6,300 BTC in State-Backed Operation

The Abu Dhabi royal family has amassed a Bitcoin reserve exceeding $700 million, sourced entirely from state-controlled mining operations rather than market purchases or seizures. Arkham Intelligence reports the UAE currently holds 6,333 BTC, signaling a strategic pivot in wealth management for the oil-rich nation.

Citadel Mining, operating an 80,000-square-meter facility on Al Reem Island, serves as the vehicle for this initiative. Its ownership structure—ultimately controlled by the Abu Dhabi royal family through International Holding Company—ensures direct state oversight of Bitcoin production. Satellite imagery and on-chain data corroborate the UAE's hands-on approach to mining.

This operation represents a deliberate transformation of hydrocarbon wealth into digital assets. Unlike Western governments that accumulate Bitcoin through law enforcement seizures, the UAE is methodically converting oil revenue into cryptocurrency via industrial-scale mining infrastructure.

Bitcoin ETFs See Six-Day Outflow Streak as Retail Investors Panic

Bitcoin's price tumbled to a multi-week low below $109,000 on August 26, marking a 2% decline from the previous day. The sell-off reflects mounting anxiety among retail investors, who are driving the longest streak of ETF outflows since April's tariff-driven downturn.

Santiment data reveals a pattern of emotional trading by retail participants, who often exit positions NEAR perceived market tops. While such withdrawals exert short-term pressure, historical precedents—like April's correction—suggest these signals frequently precede local bottoms.

Despite negative momentum indicators, Bitcoin Vector's proprietary Structure Shift metric has re-entered bullish territory. This divergence sets up a critical juncture: either price action recovers to validate the structural uptrend, or prolonged weakness undermines the bullish thesis.

Bitcoin Critic Peter Schiff Warns of Potential Drop to $75K Amid Market Weakness

Economist and longtime Bitcoin skeptic Peter Schiff has doubled down on his bearish stance, predicting BTC could fall to $75,000—below MicroStrategy's average acquisition cost. The warning comes as Bitcoin slides 13% from recent highs, trading at $109,828 amid broader crypto market weakness.

Schiff's provocative X thread urged investors to "sell now and buy back later," framing the strategy as superior to riding out a potential decline. His critique targets institutional HYPE surrounding corporate buyers like MicroStrategy, which just added 3,081 BTC to its treasury at an average $115,829 per coin.

The divergence between Schiff's doomcasting and Michael Saylor's accumulation strategy highlights Bitcoin's polarized narrative. While Schiff sees vulnerability in the 13% pullback, institutional buyers continue treating dips as buying opportunities—a dynamic fueling crypto's volatility.

How High Will BTC Price Go?

Based on current technical and fundamental analysis, BTC faces near-term resistance around $116,000 (20-day MA) with critical support at $110,000. The immediate price trajectory will depend on whether BTC can hold the $110,000 support level.

| Scenario | Target Price | Probability | Key Levels |

|---|---|---|---|

| Bullish Breakout | $125,000-$130,000 | 30% | Above $116,276 MA |

| Range Bound | $110,000-$116,000 | 50% | Current support/resistance |

| Bearish Breakdown | $105,000-$100,000 | 20% | Below $110,097 support |

William from BTCC emphasizes: 'The $110,000 level is crucial for maintaining bull cycle integrity. A sustained break below could test $105,000, while reclaiming the 20-day MA could target $122,454 upper Bollinger Band.'